Teens and Financial Responsibility

March 8, 2023

As teenagers start to earn their own money, it’s important to teach them the basics of financial responsibility. One way to do this is to open a bank account for them. However, with so many different banks and account options; it’s also a time when teenagers want to spend money on themselves.

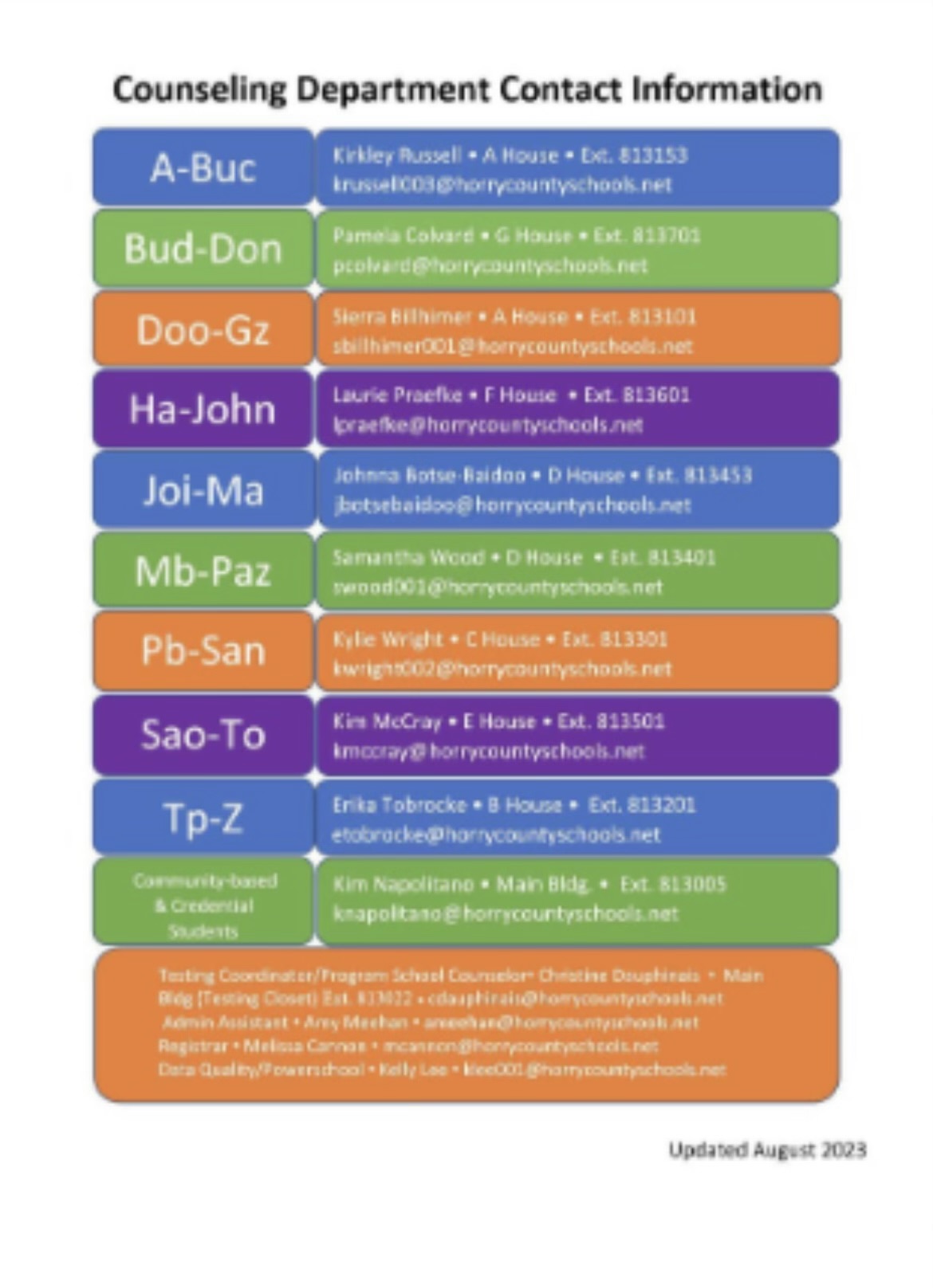

One of the personal finance teachers, Aaron Knapic, gives some great advice.

“Always live on less than you make and have at least $500 in an emergency fund.”

When choosing it’s important to learn about factors, such as fees, minimum balances, and parental controls. It’s also a good idea to learn about financial responsibility and how to use their account responsibly. With the right account and guidance, teens can start building good financial habits that will serve them well into adulthood.

The following are suggestions for anyone who is looking to start their financial journey. All of these banks have a mobile app that makes keeping up with money much easier.

Chase Bank offers a Chase High School Checking account for teens between the ages of 13 and 17. This account has no monthly fees and no minimum balance requirements. It also comes with a debit card that has built-in fraud protection and the ability to set spending limits.

Bank of America offers a student checking account for students aged 16 to 24. This account has no monthly fees and no minimum balance requirements. It also comes with a debit card that can be customized with a photo of the account holder.

Wells Fargo offers a teen checking account for teens aged 13 to 17. This account has no monthly fees and no minimum balance requirements. It comes with a debit card that can be customized with a photo of the account holder.

Capital One offers a MONEY account for teens aged 8 to 17. This account has no monthly fees and no minimum balance requirements. It comes with a debit card that can be customized with a photo of the account holder.

Kaylee Todd, a freshman, shared, ” The management I use for my credit is Credit Karma. Most of my money goes to food or new clothes, but mainly it goes into the gas station. The best part about my bank is if my card is being used online, it will send a confirmation to my phone, and I have to accept or the transaction won’t go through.”

Senior Talia Udell added, ” I used the notes app on my phone to track all my expenses. The month before, I set a budget for the next month so I have an idea of everything. I spend the most money on food/groceries whenever I go out with my friends. I like how I can take a picture of my checks to deposit them instead of having to go through the bank myself.

Opening a bank account is definitely a great way to learn about financial responsibility and help build good financial habits that will serve us well into adulthood.