Many schools across the country are doing away with home-economics and finance classes. This leaves students with many “real life” things, they have no idea about. Things like car insurance, income tax and tax returns, how to cook raw meat on a stove top, and even how to do a load of laundry; these are all things that are assumed adolescents will just ‘figure out’ on their own. And while these things may not seem trivial, they are obligatory tasks that come with being an adult and should not be left up for a student to just ‘figure out’ with no guidance.

One of the most commonly overlooked areas where a student quite honestly needs some of the most guidance is finances, especially when it comes to credit cards.

Credit cards differ from your commonly used debit card in that the money you charge on the credit card is not yours. But it does come as a surprise to many students when they find out every time they use a credit card, they are actually borrowing money from a bank. Typically, at the end of every month, money charged to the credit card is due or owed back to the bank and must be paid in full to avoid interest rates and late fees. It is also important to understand that until that money is paid back, it is considered a “balance” or debt. That’s right, I went there…the D word. You do have the option to pay the minimum payment every month which is a smaller portion of your total balance on the card that you can pay to avoid late fees–but this does not prevent interest from accumulating on your remaining balance.

An interest rate is a percentage that is charged against your remaining balance that carries over from one month to the next, ultimately increasing your balance and causing you to owe more money.

Interest rates are at an all time high right now. The following statistics are derived from many popular credit cards designed specifically with students in mind. The Discover Student Cash Back credit card has an introductory rate between 18.24%-27.24%. The Capital One SavorOne Rewards and Quicksilver Rewards also boast a hefty interest rate of 19.99%-29.99%.

Student cards are a great way to begin your credit card journey…if that’s something you are interested in. Discover, Capital One, and Bank of America, among others, offer credit cards to students who have no credit history that would qualify them for regular credit cards. There are various and sundry aspects of a credit card to consider before signing the dotted line. Different credit cards offer different benefits such as cash back advantages, lower interest rates, annual fees, monthly limit, online banking versus brick and mortar banking, and so on. It is up to the consumer to evaluate their needs from a credit card in order to choose the card best suited for them.

Cash back is a percentage the bank credits the consumer on purchases they make that can be applied to their credit card balance, used for online shopping, or cashed out for cold, hard cash. For instance, according to Capital One, the Capital One Savor Rewards credit card gives “3% back on purchases made for dining, entertainment, popular streaming services, and at grocery stores, as well as 1% back on everyday purchases.”

One of the most commonly argued reasons to get a credit card early is to build your credit score. However, it doesn’t make any sense to be persuaded into getting a credit card and not understanding what a credit score is. So, what is a credit score? And why would someone need a high score? To start, credit score can also be referred to as credit history–and a credit score is just that, a number that gives banks, lenders, and other entities that wish to determine how trustworthy or reliable you will be with their money, how likely you are to be responsible and make monthly payments based on your track record with credit cards. How long have you had a credit card open for? How reliable or trustworthy are you in terms of paying off your monthly balance every month? How much money can a bank trust you with at one time? These are all questions that are evaluated and will determine your credit score.

A credit score can be used for a lot of things, such as financing (almost anything) like a car, house, and other large purchases you might not have all the cash for at time of purchase. Having a higher credit score will help you qualify for larger loans – meaning you will be given more money to buy a more expensive car, bigger house in the area you want, and often offers you a lower interest rate. While this may seem irrelevant for a teenager or young adult, it is important to start building credit early as credit scores take time to build as banks learn your financial habits and you want to be prepared for when the time comes to make these bigger purchases.

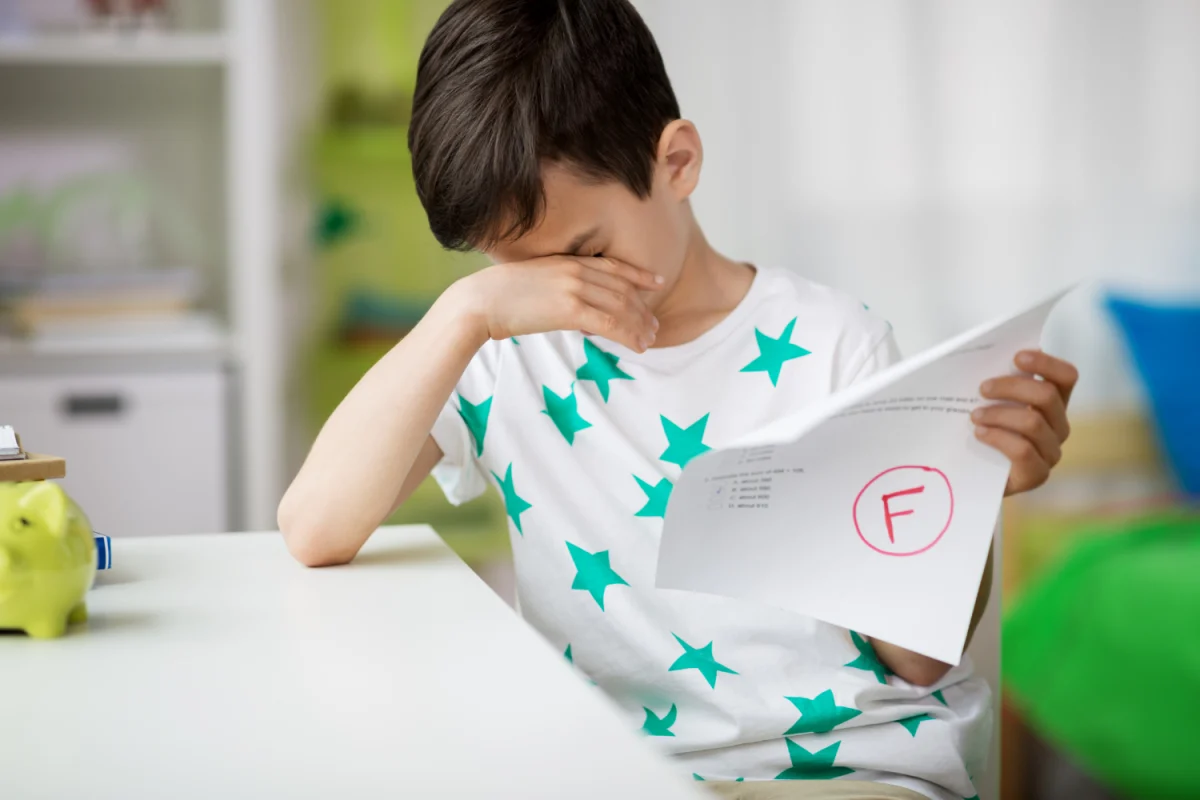

So…do you need a credit card in order to live? Contrary to popular belief, no. You do not need a credit card to make almost all major purchases. While credit cards may seem like the key to unlock the door of adulthood, they are not always the best course of action. If not careful, credit cards can easily and quickly get you into some serious debt.

Shane Kinney, a senior at Carolina Forest High School, shares his experiences with owning a credit card as a young adult.

“A huge pro for me with owning a credit card is the convenience of payments and the small rewards you are able to gain while owning a credit card. Credit score can be looked at as a plus or minus because it has the possibility to drop but it also has the possibility to higher. The convenience a credit card offers can also be seen as a downside because this allows consumers to spend more than they should. I learned the hard way.”

Credit cards undoubtedly make life a little bit easier when attempting to qualify for larger loans as all a lender needs to see is that little number tethered to your credit history to determine if you are a good candidate that is going to give them their money back. However, there are other options.

Churchill Mortgage is a lending group that specializes in homebuyers with no credit history. All loans go through a process called underwriting which is where a typical lender will do what’s called a ‘hard inquiry’ on your credit history by pulling your credit score (side note: hard inquiries actually hurt your credit score!). There is an alternative to this called ‘manual underwriting’ which is what lenders like Churchill Mortgage practice; they essentially request bank statements, monthly bill statements, pay stubs, and any other documentation required that will show them your money patterns in terms of income and outcome. This allows the lenders to better know their customers and what they can afford as opposed to just simply evaluating a number.

Aaron Knapic, one of our finance teachers, explains, “A good credit score does not mean you’re winning with your money like I once thought. People want good credit scores so they can borrow money and keep borrowing money so they can have good credit scores – we call that circular logic. I understand that buying a car isn’t always easy but ask your family/network for help, consider walking/riding a bike, or use public transportation to save up for a car. Make car payments to yourself so you can upgrade later on. The last obstacle is buying a house. Thankfully, we have companies like Churchill Mortgage that specialize in manual underwriting and don’t give you a home loan based on an “I love debt” score.”

In my experience, regardless of if you decide the credit card life is right for you or not, be all in on one or the other. Don’t use your credit card here and your debit card there; this is a very easy way to forget that the money charged on your credit card is not actually yours while also spending all the money you have in checking accounts that should be used to pay off your credit card balance.

Ultimately, there is no right or wrong when deciding whether you should get a credit card or not. There are many things to consider and many factors to weigh before signing off on a credit card, but the choice is yours. Responsibility is key and knowing how to say no to purchases your wallet simply cannot afford when you want to say yes is crucial when it comes to staying debt free.