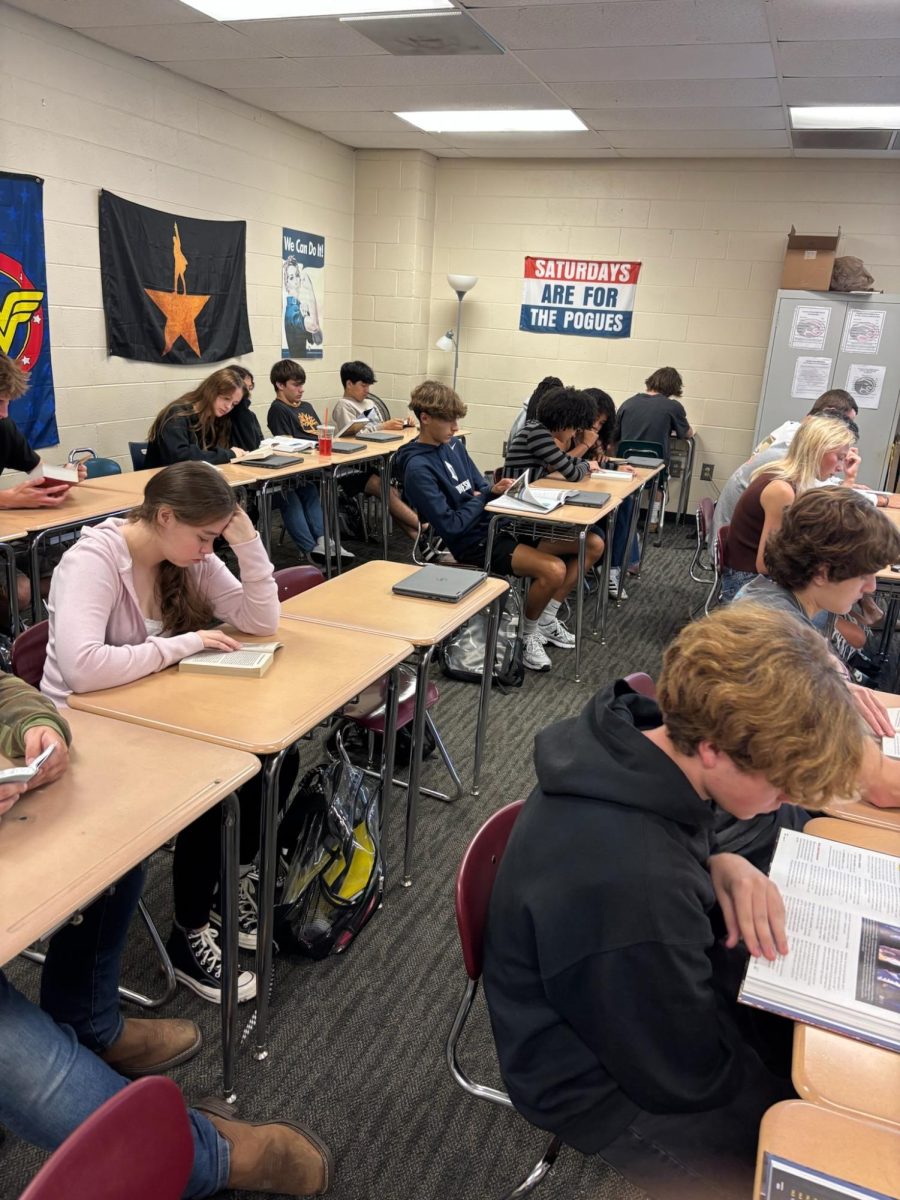

Personal Finance has just recently become a required class at Carolina Forest High School (CFHS). However, it has always been a class you could take as an elective. This is an important class to take because it teaches students all about expenses, financial independence, saving and investing, credit and debit management, insurance, and more.

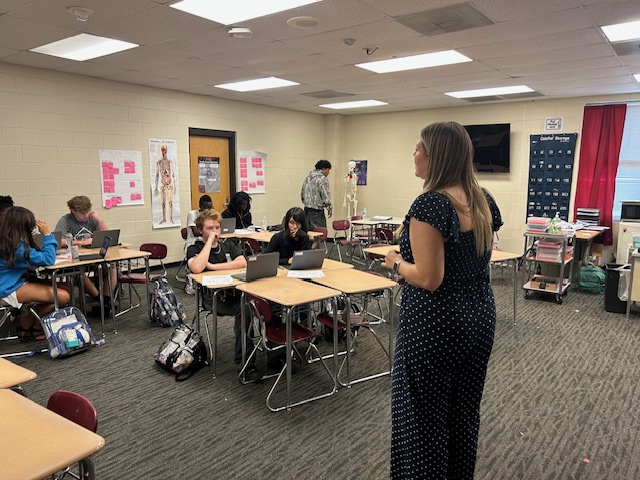

Brett Garvin, Amelia McCauley, Stan Patterson, Porrsha Dennison, and James West all currently teach Personal Finance or Advanced Personal Finance, helping our students build skills that will benefit them throughout their lives.

Aaron Knapic, a business teacher at CFHS, previously taught Personal Finance. He is adamant that this class is very important for all students.

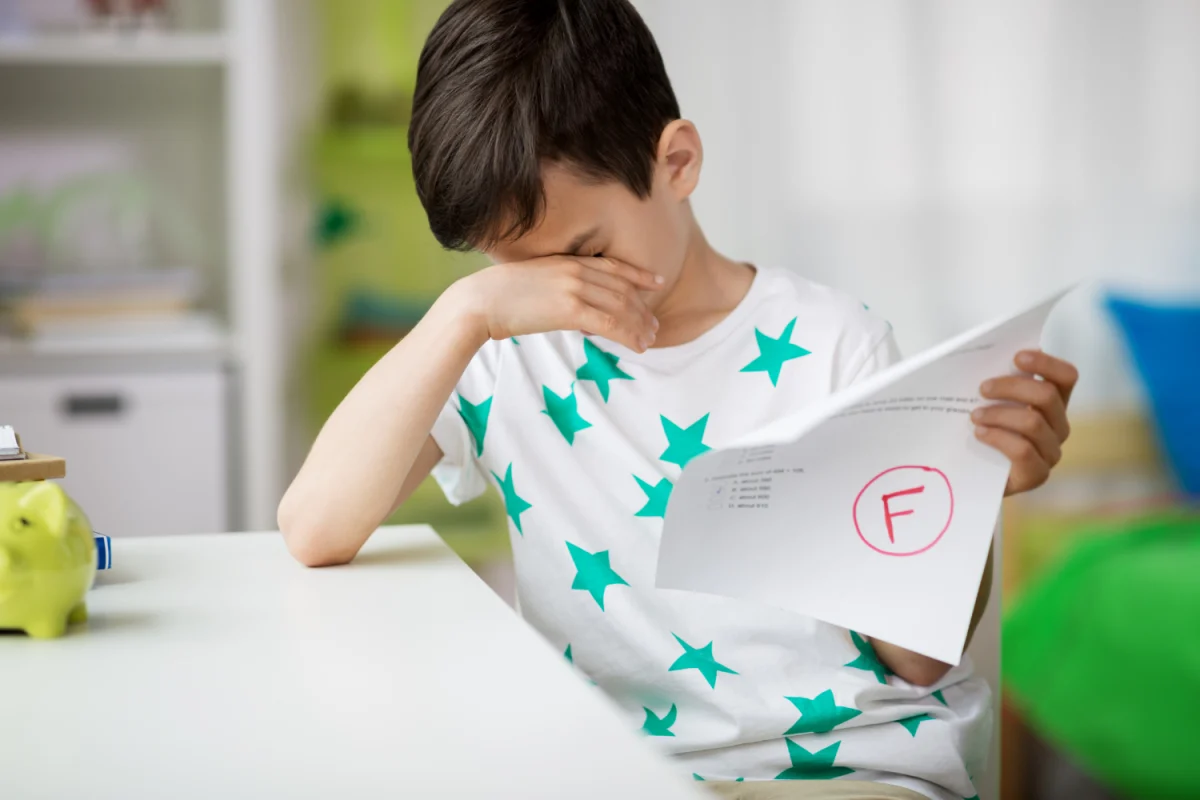

“Your decisions have a compounding effect in life, meaning the choices you make now when you’re young can have a huge impact, positive or negative, on your life down the road. Some people suffer the consequences of their poor decisions for the rest of their lives, such as having large student loan debt they pay off over decades or not investing and being able to retire early.”

Students should want to take this class because of the practical skills it teaches students that everyone should have.

Macy Turner, a junior, had Knapic as her teacher for Personal Finance. This class helped her for the future in many different ways.

“This class taught me how to use debit and credit cards, investing, buying/renting a home, and which insurance is most useful to me.”

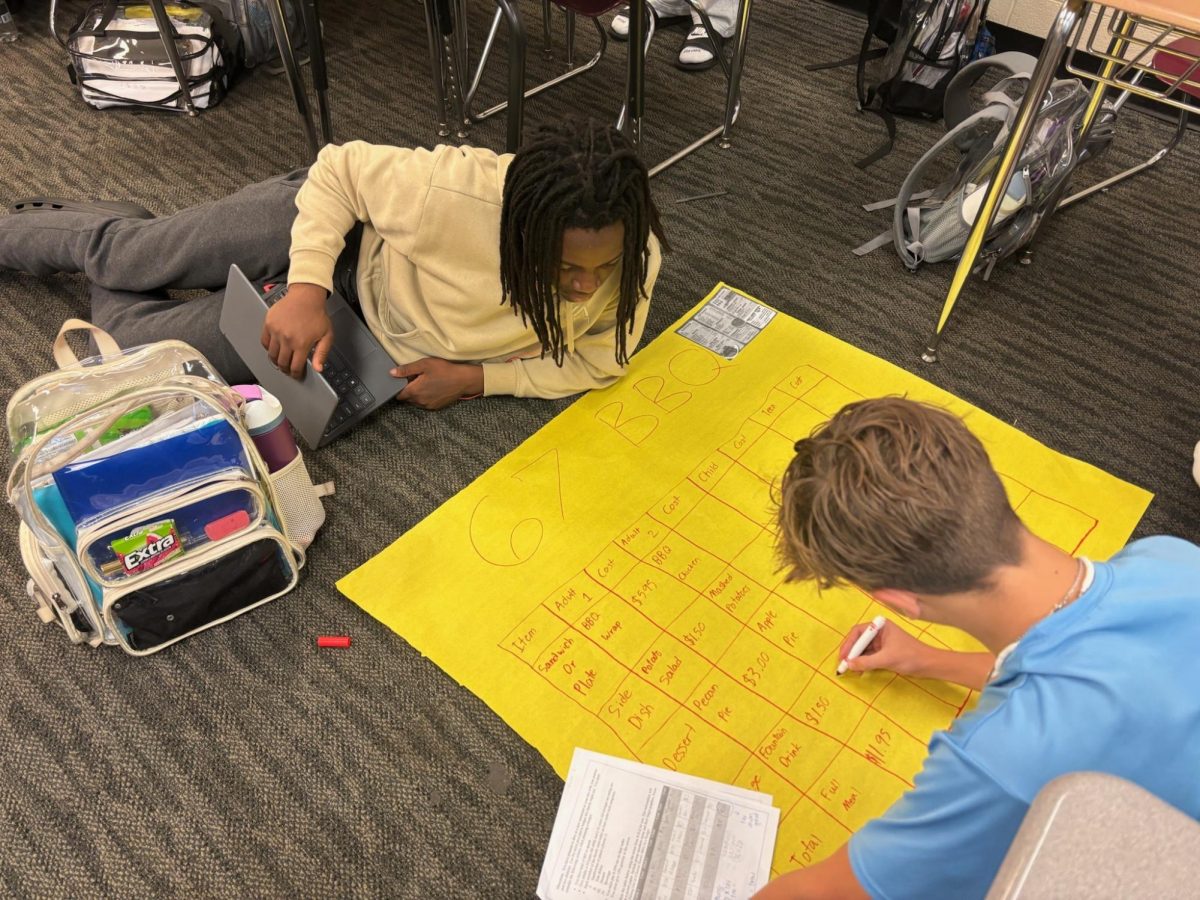

People who have taken a Personal Finance class have seen several benefits. One benefit is that this class allows for teenagers to understand how to prepare for major life events since this class teaches students how to budget their money correctly and understand the difference between wants and needs.

Students have stated that their favorite parts of the Personal Finance course are things like investing, learning how to write a check, foreseeing their careers financial future, learning how to buy a car, rent an apartment, and budgeting.

Knapic explained, “Budget in this order: Income, Giving, Saving, Spending. After giving some of your income, save and invest at least 20% for your future. After these two things, determine where and how you can live with the location/size/quality of a rental or the type of house you can buy. You live on what’s leftover after saving/investing, not save/invest what’s leftover after spending. After paying for your four necessities (shelter, food, transportation, and utilities), have fun and enjoy life with the people you care about!”

Money may seem overwhelming, but taking this class can help lower stress and anxiety when dealing with it. Any student who takes the Personal Finance course will have great future life skills. They will learn how to use money wisely, avoid debt, and achieve long-term financial goals.