In recent years, more teenagers have become interested in stock investing. It used to be that only adults with a lot of financial knowledge would invest in the stock market. Now, teenagers are also getting involved in investing and are benefiting from learning about money at a younger age.

With the help of technology and easy access to information through social media, teenagers are using tools to understand more about how investments work. Online platforms such as CFP Board provide free educational resources and even mentorship programs to help with investments. With these things, teenagers are learning about the stock market and gaining important knowledge that will be useful when opening custodial investment accounts.

The great thing about teenagers investing in stocks is that it helps them become more financially literate. They learn about things like stocks, bonds and other ways to invest money. This knowledge will help teens make smart choices about saving, investing, and planning for their future.

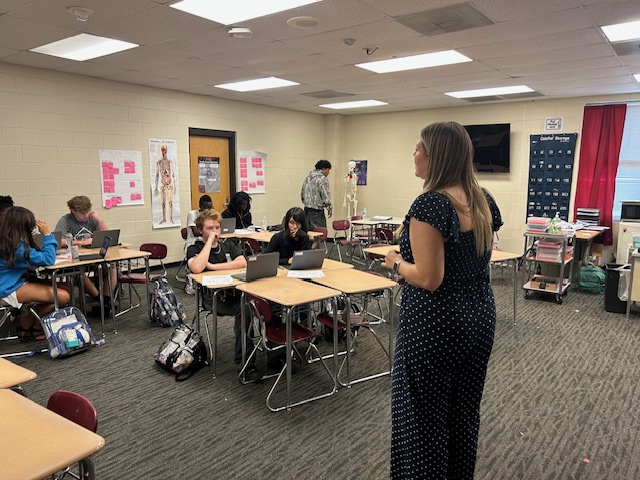

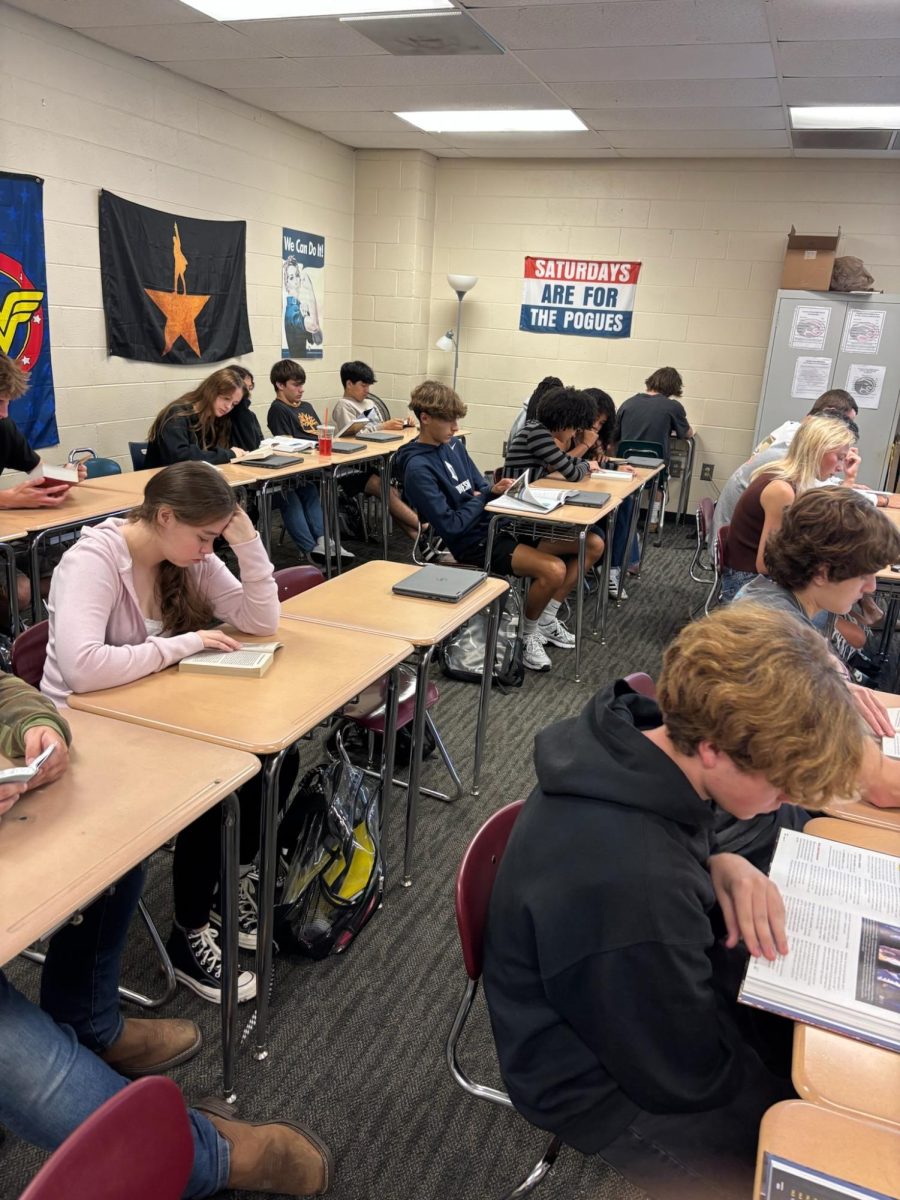

“Initially, I think teenagers should invest virtually in the stock market game to gain a greater understanding of how the markets function. If they choose to invest as a senior, then they need to understand the risks and rewards associated with the volatility of investing. With the development of 401(k)s, learning the intricacies of investing at a young age can lead to their future wealth management,” shared Toni McDowell, one of our economics teachers and former stock broker.

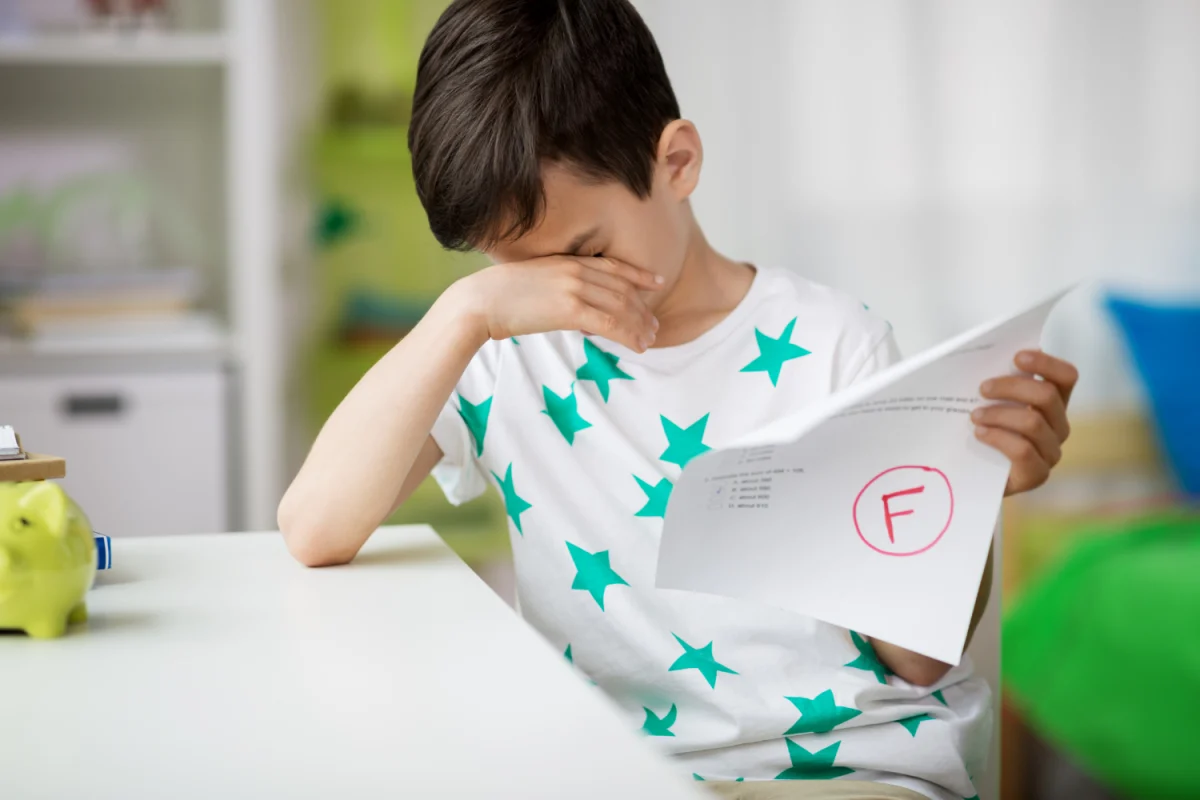

When teenagers invest in stocks, they also take control of their own financial well-being. They become responsible for making decisions about their money. This responsibility helps teens become more independent and confident. This will lead to financial success in the future.

Drayton Kelley, a sophomore at Carolina Forest added, “I originally started investing in stocks after watching “Wolf of Wall Street,” and I continued to invest to better my future.”

While there are many benefits to teenage stock investing, it is important to remember the importance of getting the right guidance and education. Teenagers should seek advice from trusted sources like financial advisors or reliable online resources. Teenagers should also remember to diversify their investments, manage risk and look at the long-term picture.

“Investing in stocks, and specifically mutual funds, is the easiest way for young people to build wealth for their futures. If you spend your life building your asset column by investing in things like stocks, bonds, real estate, companies, and intellectual property, you are operating like the rich and putting your money to work for you, so you won’t have to work for it the rest of your life,” commented Aaron Knapic, one of our finance teachers at Carolina Forest.

Mr. Knapic also shares financial knowledge and advice on TikTok. For more, follow MrKStacks.

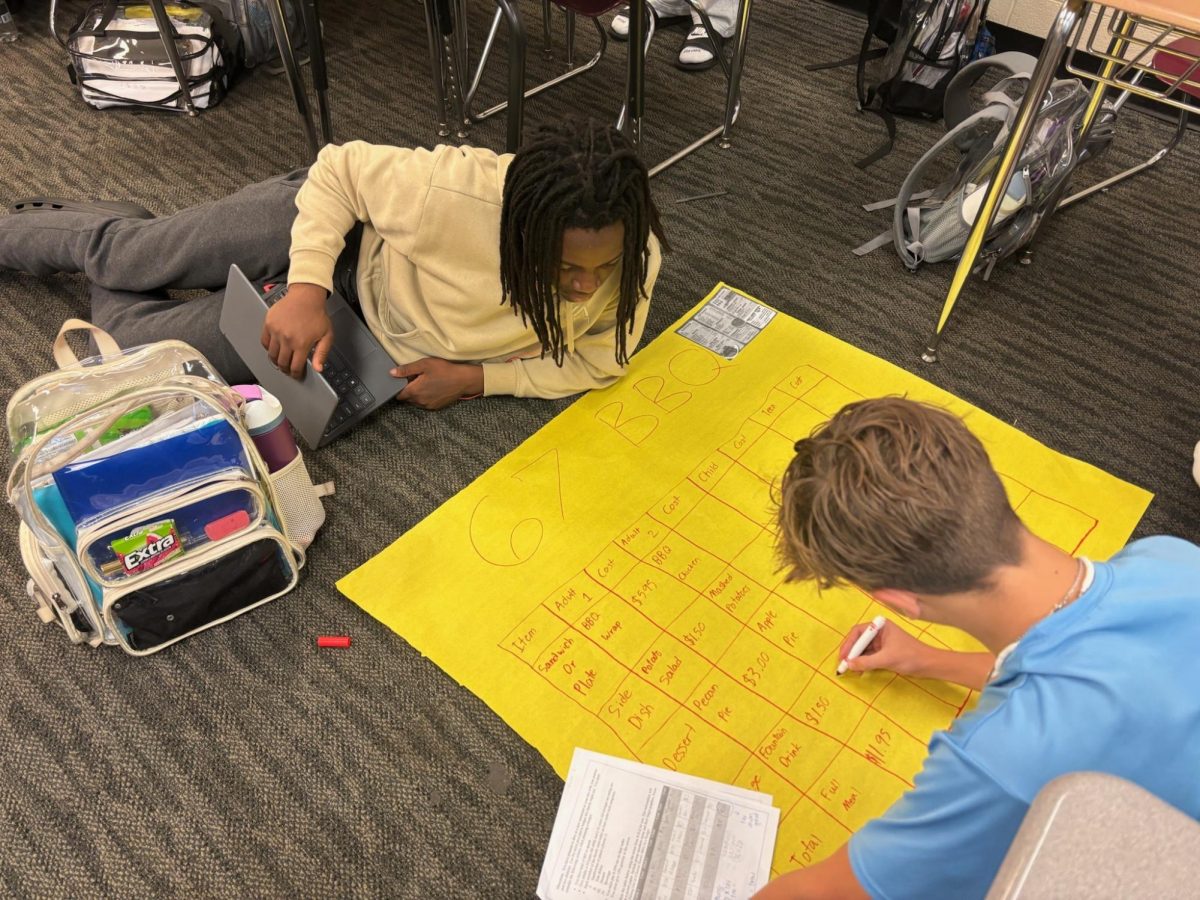

Many high schools around the United States offer classes to help increase students’ financial literacy. At Carolina Forest High School, they offer some financial courses as well, such as Personal Finance, AP Microeconomics, Economics and Accounting. The state of South Carolina has even gone as far as making Personal Finance a graduation requirement for students to become financially independent and literate.

The rise of teenage stock investing is an exciting change in the world of finance. Teenagers who invest in stocks not only learn about money but also develop discipline and a sense of responsibility. With the right guidance and education, teenage investors can build a brighter financial future.